Tax Overview

Tax Considerations For P2P Loans, Equity and Bonds

Simple Crowdfunding does not provide tax advice and the statements here are simply guidelines for ordinary UK private investors. If you have any questions about your tax situation, you should contact your tax adviser or local tax office.

IMPORTANT: The following notes are based on our understanding of the current tax position in the UK and it should be noted that this position may change in the future. The tax bands vary for Scotland. Further details of the Scottish tax bands can be found here: Scottish Income Tax.

Investors are offered three basic types of investment opportunities through Simple Crowdfunding. These are:

- Loan Based Investments – showing a ‘P2P LOAN’ badge on investment opportunities

- Equity Based Investments – showing an ‘EQUITY’ badge on investment opportunities

- Debt Based Investments - a 'BOND'

All publicly available property investment opportunities can be found here: Investments

While income and/or profits from all types are potentially taxable, the tax considerations for each type are different and are dealt with separately below.

Investment Type : Loans (P2P) and Debt (Bonds)

LOANS (P2P)

These are known variously as P2P loans, Peer-to-Peer Loans or Loan Based Crowdfunding.

Investors are offered the opportunity to provide loans to property investment projects and are paid a fixed interest return for doing this. The interest payment intervals vary by project and is clearly documented in the project particulars. Investors do not share in any gains or losses made by the developer when the project is completed. In the event the project fails and there are sufficient funds to repay all investors, P2P loan capital and interest are repayable before any distribution to shareholders.

DEBT (BONDS)

These are known variously as debt securities, bonds, mini-bonds and loan notes.

Investors are offered the opportunity to purchase fixed interest bonds issued by the fundraiser and are offered a fixed interest return for doing this. The interest payment intervals vary by project and is clearly documented in the investment particulars and Investment Memorandum. In the event the business fails and there are insufficient funds to repay all investors, company debt, including bonds are normally repayable before any distribution to shareholders.

INVESTMENTS HELD IN THE SIMPLE CROWDFUNDING IF ISA

Simple Crowdfunding offers an Innovative Finance ISA (IF ISA) for P2P loan and eligible debt (bond) investments offered through our platform. These are marked with an 'IF ISA Eligible' badge on the project image and offer the same tax advantages as a traditional ISA. Any income earned from investments held in the IF ISA is tax free.

It should be noted that the IF ISA tax-free status also means that the bad debt tax relief for any eligible P2P loan losses (see below) would not apply.

INTEREST

For most UK individual tax payers, the interest received from P2P loan and Bond investments will be treated as savings income and Income Tax is payable on that interest. Some investors who are lending to a large number of borrowers may be treated as carrying on a trade of money lending, for more details see this HMRC guidance.

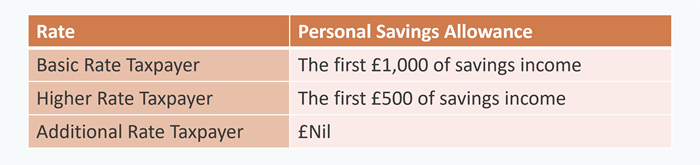

From April 2016 the government introduced the Personal Savings Allowance, an amount of savings income that is receivable tax free. P2P loan interest is included with the allowable forms of savings income. For further details, see the HM Government website.

Under current UK rules, all P2P loan interest is payable gross whereas Bond interest is paid net of basic rate tax unless (a) the bond has a term of less than 12 months or (b) it is held in a tax exempt wrapper, such as an IF ISA or pension fund.

SECONDARY MARKET

While Simple Crowdfunding does not currently offer an active secondary market, where an investor wishes to redeem their loan early, we will endeavour to assist if another investor wants to acquire their loan. The Sale Price when a loan is sold will be apportioned into:

- Capital – this is the capital outstanding on the loan

- Interest – this will be the interest earned over the period the investor has held the loan

- Premium (discount) = Sale Price – (Capital + Interest)

For the Seller, only the interest is taxable and for the Buyer, the amount of the Seller’s Interest will be deducted from their interest for tax reporting purposes.

LOSSES ON BAD DEBT (P2P ONLY)

If the company that you have lent to should fail and be unable to repay you your outstanding capital, then the HMRC allows P2P loan investors to offset the loss against other P2P loan income. Unlike the rules for losses on Equity investments below, HMRC allows this relief as soon as the loan is deemed 'irrecoverable', rather than waiting for the complete liquidation of the business.

Should a loan in which you have invested become 'irrecoverable' then we will automatically offset your capital losses against your other P2P loan interest arising in the same tax year and this will be reflected in your end of year tax report. If your losses in a tax year are greater than your income, then the excess loss may be claimed against any other P2P loan interest you have on other platforms and if anything is left, the net excess carried forward to the next tax year, to be offset against any P2P loan income arising then (for up to 4 tax years).

If the investor had previously bought the loan part from another investor at a premium, tax relief is only given on the Capital (less any subsequent Capital repayments). If the loan had been bought at a discount, then tax relief is only available on the Capital minus the discount (less any subsequent Capital repayments).

Any subsequent recovery distribution (when the business is sold or wound-up) will be treated as income (interest).

Investment Type : Equity

For most Equity projects offered through the Simple Crowdfunding platform, the return to investors will be following the completion of the project and the disposal or refinance of the resulting units or uplift. In some cases, there may be an income flow during the course of the project and where that happens, such income normally will be distributed as dividends.

DIVIDENDS

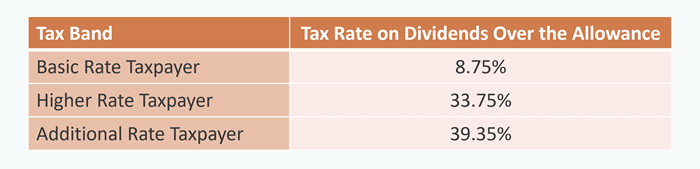

As with any interest earned on P2P loans and Bonds, dividends are taxable as income. Under current UK tax rules there is a £500 annual dividend allowance - this is separate to the Personal Savings Allowance which applies to P2P loan and Bond interest but not dividend income. For dividend income received in a year above the annual allowance, this is taxed at the following rates:

GAINS (LOSSES)

The normal position is that at the end of a project investors are returned their initial capital plus their share of the profit (or net of their share of any losses). This may be effected in various ways (a sale of the SPV to another company, a share buy-back, a distribution of the assets resulting from the winding-up of the business, etc).

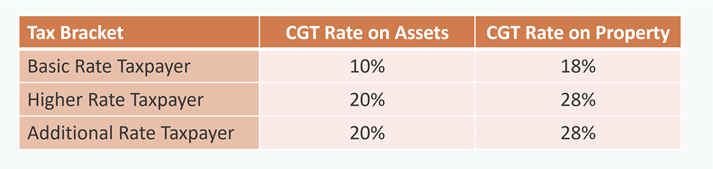

If the fundraiser intends to share any profits as dividends, the treatment will be noted as above or as a disposal of shares subject to capital gains. If the distribution is not by way of dividends, then the typical position is that any profits (gains) are potentially liable to Capital Gains Tax (CGT) and any losses may be offset against those (or other) taxable gains.

Note: While the fundraiser will set out how they intend to reward investors, not every investment project proceeds as intended and it is possible that dividends may be paid instead of capital profits and vice-versa.

As with dividends and savings interest, each individual investor has an annual nil rate band, with increases announced each year in the Budget. The bands for last year, this year and next are:

Any gains above this are taxable. Where the gains have arisen from investments in residential property then a higher tax rate applies.

Note: The definition of residential property is very widely drawn. It should be assumed that unless a property will be only for commercial use throughout the period of ownership (i.e. strictly non-residential use - other than some specific exceptions for education, nursing, hospices, etc) then the higher rates apply - so a commercial property with a change of use to residential or planning permission for the same would most likely be deemed residential for these purposes.

SECONDARY MARKET

Simple Crowdfunding does not currently offer an active secondary market. Where an investor wishes to sell their shares early, we and the developer will endeavour to assist if another investor wants to acquire them. Any gains or losses will be subject to CGT as above.