Property Investment: Equity Vs Peer to Peer Lending

The Difference Between Peer To Peer Lending & Equity Crowdfunding

We often get asked about the differences between equity investing and peer to peer lending through the Simple Crowdfunding platform. To answer this, we thought it would be useful to provide a summary of the key terms and the core differences, starting with what is crowdfunding?

What is Crowdfunding?

More and more people are investing and raising funds for their businesses, property and good causes through crowdfunding platforms such as ours. So, what exactly is crowdfunding?

The Financial Conduct Authority (FCA), the regulatory body in the UK, defines crowdfunding as this:

“Crowdfunding is a way which people, organisations and businesses can raise money through an online portal (crowdfunding platform) to finance or re-finance their activities and enterprises.”

In its simplest form, crowdfunding is the ability to raise finance for a business, property, product or social reason from a number of people, each contributing varying amounts towards the cause. It is an increasingly attractive method of raising capital, instead of using traditional finance. In the property sector, crowdfunding is used by many SME developers to raise finance for their property projects.

Property Crowdfunding is where a number of investors finance the property project. This type of investment opportunity is available to almost everyone, with many people investing varying amounts into a property project. Some projects also offer learning opportunities, allowing investors to learn about planning gain, construction or property conversion.

Property crowdfunding usually takes one of two forms, namely equity investments and peer to peer lending. The two types vary in their risk and return profiles and it is really important to understand the differences. These are explained below.

Equity Crowdfunding

For an equity investment opportunity, the investor is typically buying shares in the company that owns the property. The property can be a plot of land, a building or other property asset. In essence, the investor becomes a part owner (shareholder) of the company that owns the asset.

Returns are received in the form of dividends and capital growth. Dividends can be paid throughout the project (based upon rental income for example) and capital growth that is usually paid at the end when the project is sold or re-financed.

If the company becomes successful and increases its value, so will the investor’s share in that company. If the company does not perform as well as expected, the value of the share will go down.

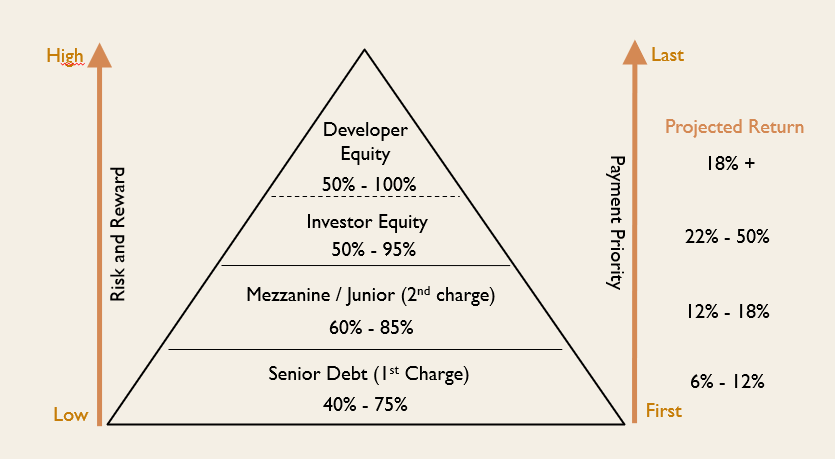

Equity risk and return

With equity investments, other finance providers (where the fundraiser may take a development loan) are likely to be paid back before shareholders receive their capital and projected returns. With property investment, the exit is often a refinance or sale. Some investment projects also provide regular interim payments in the form of dividends.

Equity is considered a higher risk investment than peer to peer lending and therefore usually offers a projected higher return. Naturally, the projected returns offered will vary from one investment opportunity to another. Ultimately, it is up to the fundraiser to decide what projected return could be made available to investors. Investors then decide whether they wish to take part.

Peer to Peer Lending

If you invest in a peer to peer loan, in essence, you are lending money to the property developer. You are like the bank, loaning money for a fixed period of time (term), for a fixed return. Interest payments will be made periodically or, in some cases, at the end of the loan term. The loan is usually secured against the property, and often on a first charge basis (so you are first in line to be repaid).

One of the main advantages of peer to peer lending opportunities is that the investor can invest using an ISA wrapper. The type of ISA that can be invested is called an IFISA (Innovative Finance ISA). The benefit is that these IFISA’s are exempt from both income and capital gains tax on the investment returns, and no tax is payable on money withdrawn from the ISA scheme.

The terms peer to peer lending, debt and bonds are often muddled up and whilst in principal all are lending funds, there are marked differences from the technical, payment and regulatory perspectives.

Peer to peer lending risk and return

These investments are regarded as a lower risk than equity and typically offer a lower projected return. Peer to peer lending investment opportunities will typically have some form of security, which means that there is a ‘charge’ over an asset. Charges can be a first charge which means you get paid first. Secondary (or later) charges means that the charge holder gets paid after the higher ranking charges have been paid. First charge holders typically control whether to trigger a demand for payment.

Security

Some platforms require security in order to further secure investor funds. Whilst this does not guarantee that an investor will receive their funds back if a project does not go to plan, there is a better chance that funds will be recoverable.

An example of when security may exist is in a crowdfunded property project is where a fundraiser has a piece of land and wishes to raise finance for the development and build. The platform will look to take a registered charge on the land. The value of the investment must be enough to cover the original amount borrowed and associated interest / fees.

Investment Choices: Things to Consider:

- Lending provides a more stable and predictable return than equity

- Lending typically holds a charge on an asset

- The holding period is known for lending, and is often shorter than with equity

- It is possible to invest through your ISA for tax-free returns when lending

- Equity has the potential for bigger returns

- Typically, the higher the projected return, the higher the projected risk

Below is a graph that shows the payment priority alongside the risk and return profile for a typical project.

Simple Property Crowdfunding

At Simple Crowdfunding, we offer both equity and peer to peer lending investment opportunities under one roof. On our Invest Page, it is easy to tell the difference between the two types of investments:

- Equity projects have a copper border and have an 'Equity' badge on the project image.

- Peer to peer loans have a grey border and have a 'P2P Loan' badge on the project image. There is a second badge that says whether the opportunity is 'IF ISA Eligible'.

While the above sections discuss the relative balance of risk and return between equity and peer to peer lending, all crowdfunding investments carry a degree of risk and returns are not guaranteed. Remember to always do your own due diligence, read the information provided and ask questions.

Want to find out more? Contact the Simple Crowdfunding team.

#propertycrowdfunding #equitycrowdfunding #peertopeerlending #simplecrowdfunding #balancedportfolio #equityinvestment #p2p #property #investment #36h #raisefinance #propertyfinance

- UK Property Market June 2025

- Commitment to Industry Excellence

- Navigating the Landscape of Property in 2025

- Investor Benefits: Accessible Property Investing

- UK Property Market 2024: Recap and Predictions

- IFISA Provider of the Year 2024

- Fundraiser Benefits

- Financial Promotions Order

- Unlock the Power of Property ISA Investing

- Celebrating 10 Years

- The Importance Of Switching Off

- P2P Finance Awards 2023

- Property Investment: Equity Vs Peer to Peer Lending

- Investment Due Diligence

- ISA Investing

- Simple Crowdfunding 2022 Review & Highlights

- Shortlist - CEO of the Year Award

- Financial Inclusion Shortlist

- P2PFN Power 50 2022

- Melanie Omirou, Acorn Property Group